Your 12A & 80g Registration with Sk Filling Wala

Step 1

First, we'll have a consultation with you to assess your NGO's needs & determine which services are necessary.

Step 2

Next, we'll guide you through the paperwork & legal requirements needed to register your organization.

Step 3

We'll work with you to ensure that your NGO is in compliance with all applicable laws & regulations, & ready to make an impact.

What Is 80G 12A full details

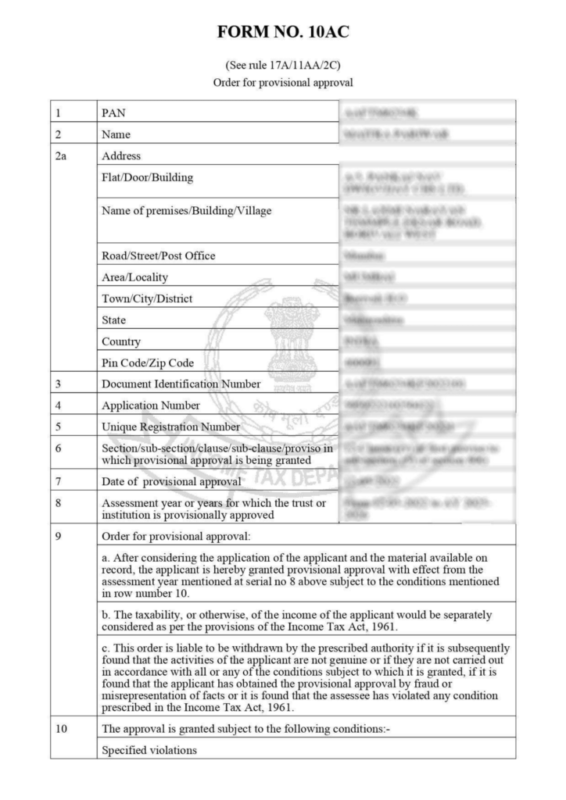

80G 12A Certificate

What Is 80G 12A Full Details?

What Is 80G 12A full details:

An NGO that wishes to accept tax-deductible donations must secure a “12A” and/or an “80G” certificate. The procedure for securing these certificates is normally completed shortly after the NGO’s incorporation. Our team of professionals will work with the appropriate departments to ensure that your organization gets the tax benefits it deserves.

The process of securing a 12A or an 80G certificate can be complex and lengthy, and it is essential that your organization follows the required guidelines to avoid any complications. Our team of experts can handle all of the paperwork and compliance on your behalf, ensuring that the entire process is as stress-free as possible for your nonprofit organization.

12A and 80G registration are a must for any non-profit in India aiming to thrive and make a lasting impact on society. These certificates provide substantial tax benefits, enhance donor trust, and ensure legal compliance, all of which are vital for the long- term sustainability of any NGO.

What is an 80G certificate:

An 80G certificate is a certificate issued by the Income Tax Department to a non- profit entity such as a charitable trust, NGO, or Section 8 Company. It allows donors to receive a tax exemption of 50% when they donate funds to these organizations, as they can deduct the amount from their gross total income. To claim the tax exemption, the donor must attach a stamped receipt from the NGO that specifies the name of the NGO, the date of the donation, and the NGO’s PAN.

To qualify for 80G status, an NGO must meet certain criteria:

A non-profit must be constituted as either a public charity or a registered society. In addition to this, the NGO must have been in operation for a minimum of three years and must be regularly publishing its accounts in accordance with Section 44AB. Additionally, the NGO must be devoted to charitable activities and should not derive any benefit from its assets or income.

Lastly, the NGO must submit a copy of its original RC, MoA, or Trust Deed as part of the application for 80G status. The Income Tax Department will also conduct an on- premises inspection of the NGO as part of the application process.

How to apply for 12A and 80G status:

If you are a charitable institution in need of 12A and 80G registration, the process can be complicated and time-consuming. It is important to follow the proper steps in order to avoid any errors or delays, which could cause your application to be rejected by the IRS. Ensure that you have all of the necessary documents before applying, and allow for enough time to complete the process. The process typically takes about a month. It is also helpful to keep in contact with the IRS during this time in case there are any questions or issues. By following these simple steps, you can successfully register your organization for 12A and 80G status.