NITI Aayog Registration Online NITI Aayog registration online can be done by all the NGO, Trust and Society firms. Individuals cannot register on this portal. It offers multiple benefits such as a unique ID, access to government schemes and funding, etc. It also increases the credibility of the NGO to receive gifts from the general […]

Author Archives: Skfillingwala

Trademark Registration Fees for NGOs trademark registration fees is an important step for NGOs to protect their brands and reputations. In addition to providing legal protection, trademarks boost NGO credibility and make them more attractive partners for collaborations and funding. There are various fees associated with trademark applications, depending on the filing basis. For example, […]

Society Registration Online Procedure and Documents Society registration is an essential process that gives legal personality to your organization, allowing it to own property, enter into contracts, and sue or be sued. It also enables you to access funds easily. The first step is to select a unique name for your organization. This should be […]

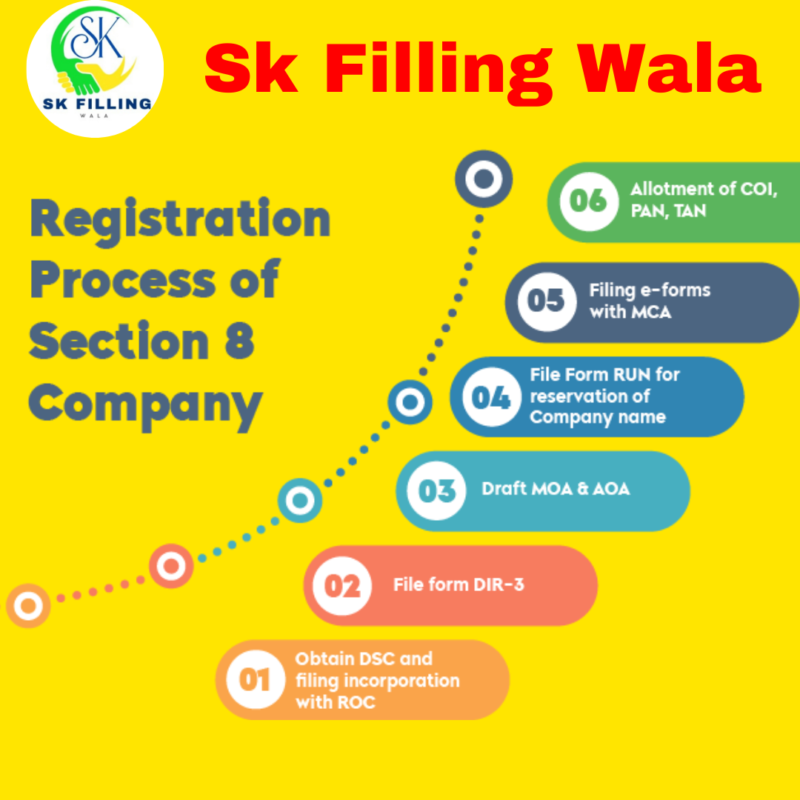

Section 8 Company Registration Online Section 8 Company Registration gives your organization credibility and trust among donors. It also provides a distinct legal identity, which allows it to enter into contracts and sue or be sued in its own name. To begin the process, you will need to submit an application form. Then, you will […]

Income Tax Filing Online income tax filing online is a vital step in keeping financial health. It provides a record of earnings and allows you to claim credits. It also serves as a necessary document for loan applications. The best free tax-prep software offers a free tier for basic returns and supports the majority of […]

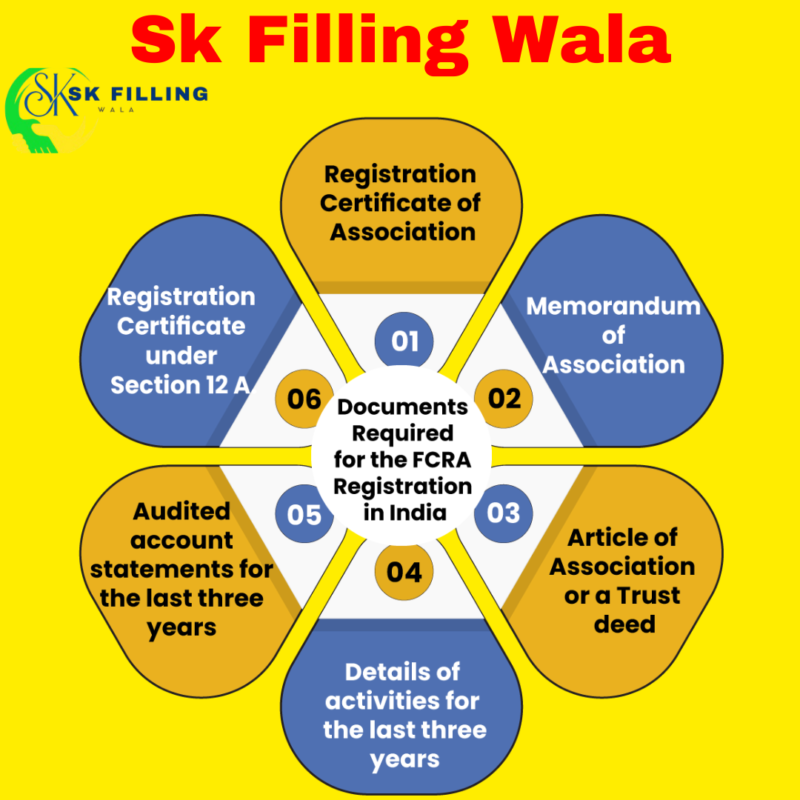

FCRA Registration: Process Fees Requirements Eligibility FCRA registration process enables charitable groups to receive foreign donations. It also helps build trust with donors and stakeholders. The process of applying for an FCRA certificate can be complicated, however. To begin the process, NGOs must first access the online FCRA portal. After logging in, they must click […]

Introduction to CSR-1 Registration Online Form for NGOs Today, organizations use Corporate Social Responsibility (CSR) to return profits to society. This trend is growing fast. Corporates now know that a company’s success is not just about profits. It’s also about its impact on society. CSR-1 Registration Online Form for NGOs is the bridge that connects […]

Do you manage a trust or an NGO? Are you wondering how these 12A & 80G Registration Benefits for Trust NGOs can boost your mission? These registrations are not mere formalities. They are the way to build your NGO’s financial strength and credibility. 12A & 80G Registration Benefits for Trust NGOs gives excellent benefits. They […]

NGO Registration Service – NGOs, or Non-Governmental Organizations, are solving global social, environmental, and cultural issues. If you care deeply about an issue, and want to make a difference, then you must register your NGO. It’s the most important step. It legalizes your organization. It also grants credibility, funding, and support from local and global […]

- 1

- 2