Pranav Tiwari: A Young Visionary Shaping Digital Success In an era defined by rapid digital transformation, where innovation is constant and the landscape shifts almost daily, certain individuals emerge as true pioneers. Pranav Tiwari stands out as one such visionary, a young entrepreneur whose journey from a small town in Uttar Pradesh to the bustling […]

FSSAI Registration – Building Consumer Trust and Expanding Your Food Business FSSAI Registration is a mandatory step for all businesses that produce or distribute, store and sell food products. It can help you avoid penalties as well as legal troubles. To obtain an FSSAI license is as simple as filling out the Form A, or B, […]

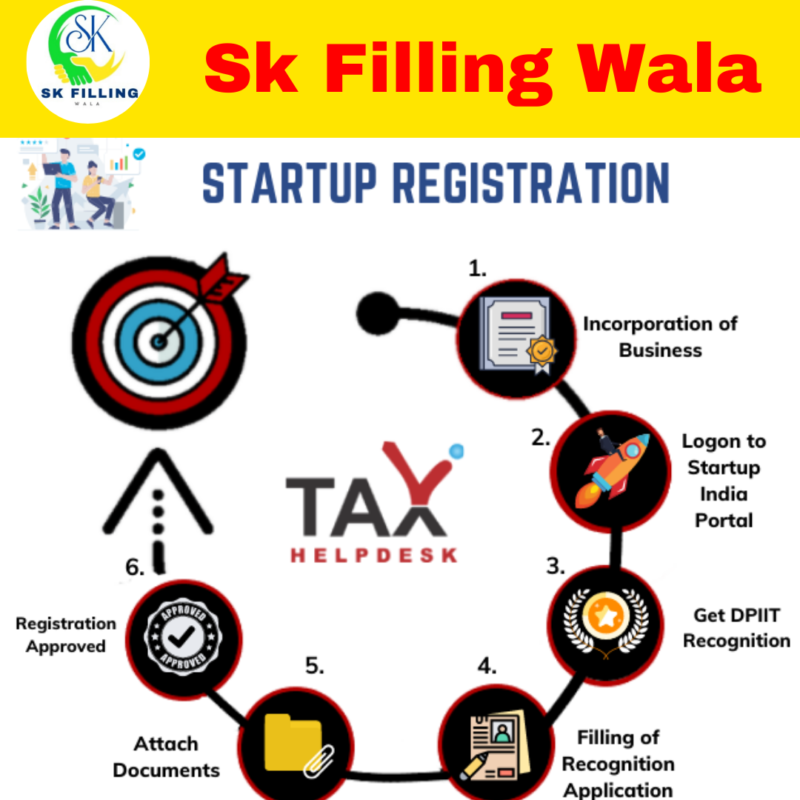

Startup India Registration – How to Register a Startup in India The process of obtaining startup India registration fees is essential for entrepreneurs to be eligible for incentives and government benefits. This includes tax exemptions for three years, simple access to government tenders and many more. To apply to apply for Startup recognition Visit the official […]

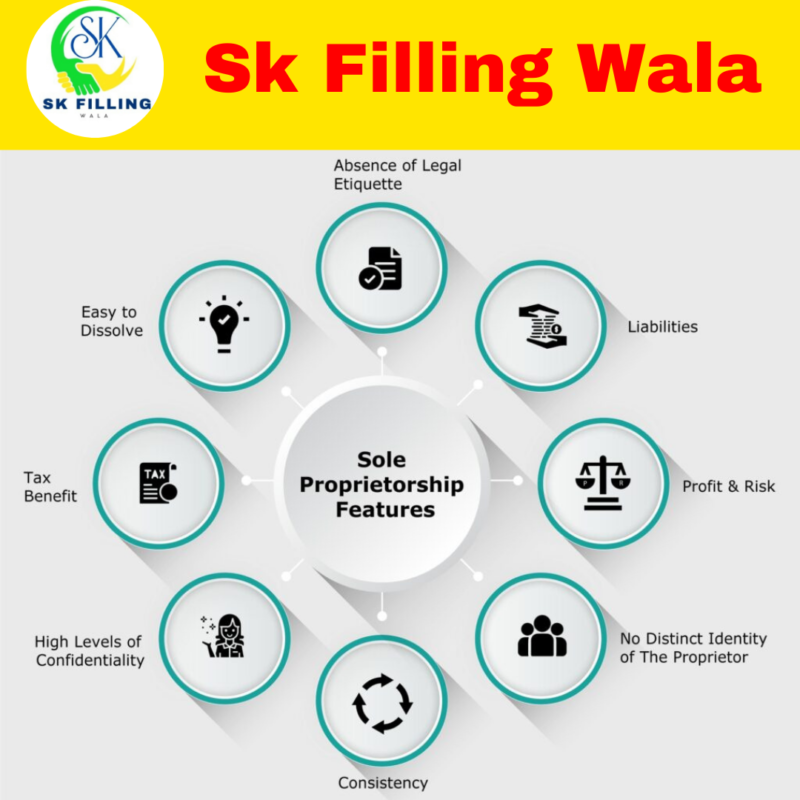

Sole Proprietorship Company Registration A Sole Proprietorship is the simplest business structure. Unlike entities like an LLC or Corporation, you don’t have to file business registration paperwork with the state. sole proprietorship company In New York, you’re considered a Sole Proprietorship as soon as you start conducting business activities. However, you may still need to […]

One Person Company Registration One-person company registration permits one person to run as a company with the protection of limited liability. For registration of a single company, you’ll need to get an electronically signed certificate (DSC), make a reservation for a name, make your Memorandum of Association (MOA) and Articles of Association (AOA), and then submit […]

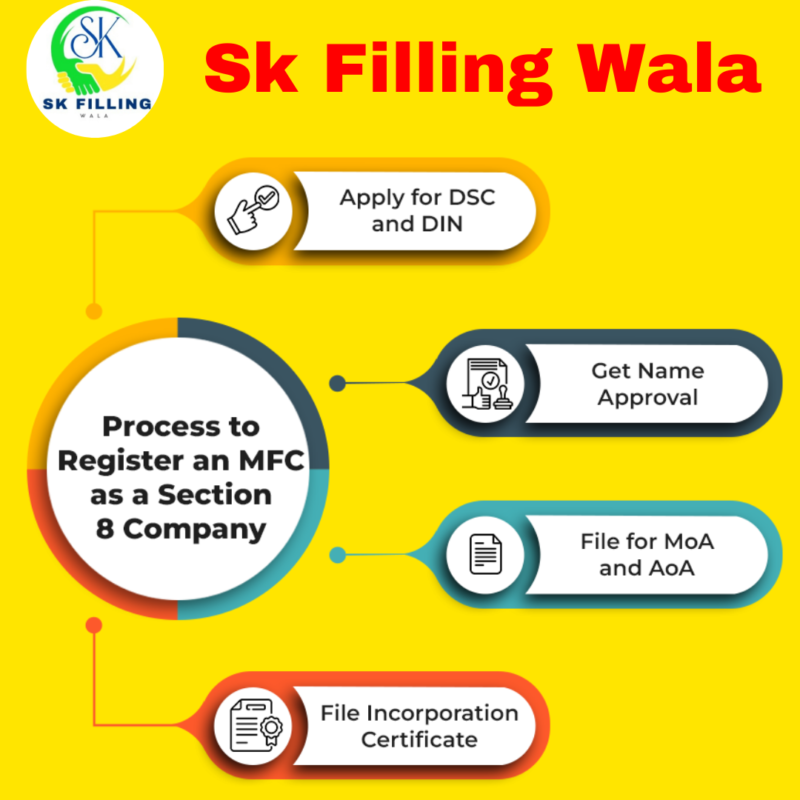

Microfinance Company Registration Registration with a microfinance business gives a host of advantages that include formal recognition as well as access to financing. They also help them adhere to legal guidelines that promote responsible lending practices and increase the social impact of their loans. microfinance company registration To get the certification of beginning your business, […]

Pvt Ltd Company Registration Pvt Ltd Company Registration is a legal business structure with advantages like separate legal existence, limited liability, easy transferability of ownership, and eligibility to get loans. It is also required to adhere to a number of compliances. The minimum requirements include identity proof (passport, driver’s license, or national ID card), address […]

ITR 1 Full Details ITR 1 is a simple return form of one page for individuals. It can be filled out with central officials, PSU personnel, pensioners as well as other individuals. Individuals who earn a living from a single property can file ITR 1. However, those who own multiple properties in their homes or earn those […]

NGO Darpan Registration Full Details Ngo Darpan Registration is a free service that permits organizations and VOs to connect with the central ministries, departments and government entities. It also assists them in building their credibility and establish trustworthiness. ngo darpan registration process Furthermore, Ngo Darpan Portal Registration is essential to gain access to grants from the […]

MSME Udyam Registration MSME Udyam Registration is a new certification from the Ministry of Micro, Small, and Medium Enterprises that gives MSMEs access to many government benefits. This article navigates the benefits, eligibility, and process of obtaining an MSME Udyam Certificate. Benefits include legal protection against delayed payments, reduced electricity bills, and discounts on ISO […]

- 1

- 2