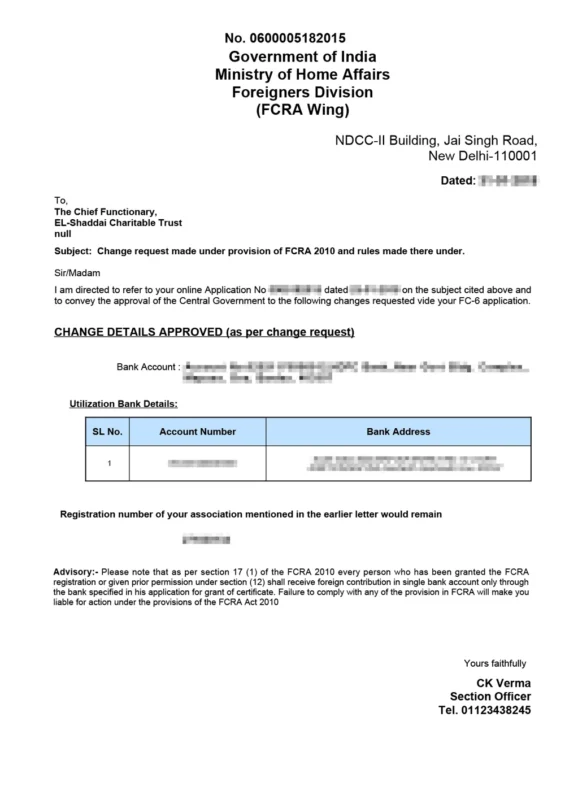

FCRA Registration

Get FCRA Registration to legally accept foreign contributions for your non-profit organization. Eligible entities include Section-8 companies, societies, and trusts focused on charitable objectives. Benefit from global contributions no

Register under Companies Act or Society Registration Act.

Registered under Indian Trust Act.

Provide charitable services, with no risk to safety or violation of FCRA provisions..

Contact Us

Your FCRA Registration with Sk filling wala

We have simplified the process for you and can be done online with NGOExperts in 3 simple steps:

Step 1

First, we'll have a consultation with you to assess your NGO's needs & determine which services are necessary.

Step 2

Next, we'll guide you through the paperwork & legal requirements needed to register your organization.

Step 3

We'll work with you to ensure that your NGO is in compliance with all applicable laws & regulations, & ready to make an impact.

What Is FCRA full details

FCRA Certificate

What Is FCRA?

Credit reporting agencies are the three major players (Experian, Equifax, and TransUnion) that provide financial institutions with information about consumers’ financial history. This info is used when making decisions about loans, credit cards and other big-ticket items like homes and cars. The Fair Credit Reporting Act (FCRA) is a federal law that regulates the information these companies can give to these institutions and others who use it to make decisions about you. It also gives you rights and resources to dispute inaccurate information.

In addition to allowing you to access your own credit reports for free, the FCRA limits who can access your file to those with a legitimate need. This usually means banks, insurance companies, employers and landlords. Additionally, you must be told if a consumer reporting agency has used your report to deny you employment or credit. The CFPB enforces these rules, along with the Federal Trade Commission and your state attorney general.

One of the most important aspects of the FCRA is your right to dispute inaccurate or incomplete information in your file. If you find something that isn’t right, the CRA must investigate and correct it within 30 days. If the disputed information cannot be verified, it must be removed from your file. The CRA must also tell you who requested your report within the past year or two, depending on the type of request.

The CRAs must also let you know if they are sharing your data with affiliates or other businesses for marketing purposes. The CRAs must also notify you when there is a security breach that exposes your personal information. These obligations were extended in the Enhanced Privacy Protections of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (EFCA).

In addition, when you’ve disputed an inaccurate item with a creditor that submits it to a CRA, the creditor must notify the CRA in writing within 30 days. The CRA then must contact the furnisher and ask for the verification of the incorrect information, or if it still can’t verify it, the CRA must delete the inaccurate item from your report.

Another part of the EFCA is a requirement to destroy digital information that has been discarded by a CRA or a furnisher. This can be done by overwriting the data with a new entry, or physically destroying it. The CFPB has issued guidelines to help organizations comply with this rule.

While the 116-page FCRA contains several other important provisions, these are the most important to keep in mind. If you believe any of these laws are being violated, it’s important to talk to a lawyer about your options for pursuing legal action. A skilled attorney can help you navigate the many complexities of this complex federal law. In addition, a lawyer can help you understand how to best protect your credit and financial records. Eric Rosenberg is a finance, travel and technology writer in Ventura, California. He has an MBA in finance from the University of Denver. When he’s not writing, he enjoys exploring the world and flying small planes.