Section 8 company Registration

Section 8 Company Registration promotes social welfare, sports, education, and aiding lower-income groups. Eligible for individuals, HUFs, & limited firms. Get benefits by fulfilling criteria.

At least one Indian resident director.

Eligible entities: Individuals, HUFs, & limited companies..

Social welfare objective: sports promotion, education support, or aiding lower income groups.

Contact Us

Your Section 8 Company Registration with Sk filling

We have simplified the process for you and can be done online with NGOExperts in 3 simple steps:

Step 1

First, we'll have a consultation with you to assess your NGO's needs & determine which services are necessary.

Step 2

Next, we'll guide you through the paperwork & legal requirements needed to register your organization.

Step 3

We'll work with you to ensure that your NGO is in compliance with all applicable laws & regulations, & ready to make an impact.

What Is Section 8 Company Registration full details

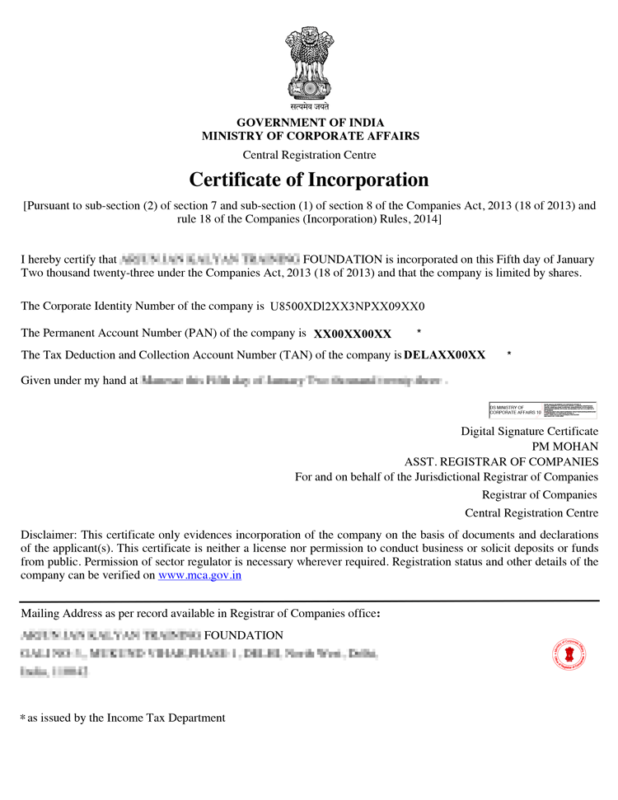

Section 8 Certificate

What Is Section 8 Company Registration Full Details?

A Section 8 Company Registration full details is a non-profit organization registered with the Ministry of Corporate Affairs (MCA). It can be set up to promote arts, commerce, education, charity, social welfare, sports, health, protection of the environment, research, science, religion, and any other activity that has a charitable motive. This kind of company cannot distribute dividends to its shareholders and must utilize its profits to promote the goods for which it was registered. The central government can cancel its license if the company is found to be operating fraudulently or in violation of its goals.

The company must submit proof of identity for all directors and members, as well as a declaration that it complies with Section 8 requirements. The company also needs to prepare drafts of its MoA and AoA, outlining its internal governance structure and social objectives. Once all documents are prepared, the company must submit them to MCA along with the necessary fees. Upon receiving approval from the ROC, the company will be issued its Certificate of Incorporation.

There are several benefits of registering a Section 8 Company, including tax exemptions for donors. This makes it easier to attract funding and donations. In addition, the company enjoys enhanced credibility and trustworthiness due to its non-profit status.

Unlike other types of companies, a Section 8 Company does not need to maintain minimum paid-up capital. It can be incorporated as a private limited or public limited company, and there is no maximum limit on the number of members. Moreover, the company can remove the word “Limited” or “Private Limited” from its name if it chooses to do so.

Another benefit of a Section 8 Company is its perpetual existence. Unlike Trusts, which have a specified end date, Section 8 Companies can continue to operate for as long as they have sufficient assets. This type of company can also borrow funds from financial institutions and investors, and its directors and members are not liable for any debts the company incurs.

A section 8 company must file annual returns and financial statements with the ROC. It must also maintain proper books of accounts and have them audited regularly by a Chartered Accountant. Furthermore, it must conduct regular board meetings and AGMs, with a maximum gap of 120 days between each meeting.

Additionally, the company must adhere to all other legal requirements as set out in the Companies Act. For example, it must file its statutory reports on time and pay taxes and other fees. It must also appoint a Company Secretary and keep records of its members and directors. The company must also abide by the law regarding money laundering and other illegal activities. If it violates the law, the directors and officers could face heavy fines.