Trust Registration

Trust registration is the first step in establishing a legal entity for charitable purposes. With proper compliance, you can enjoy the benefits of tax exemptions and more.

Minimum of two persons

Compliance with Indian Trusts Act, 1882

Objectives aligned with Indian laws and regulations..

Contact Us

Your Trust Registration with Sk filling

Step 1

First, we'll have a consultation with you to assess your NGO's needs & determine which services are necessary.

Step 2

Next, we'll guide you through the paperwork & legal requirements needed to register your organization.

Step 3

We'll work with you to ensure that your NGO is in compliance with all applicable laws & regulations, & ready to make an impact.

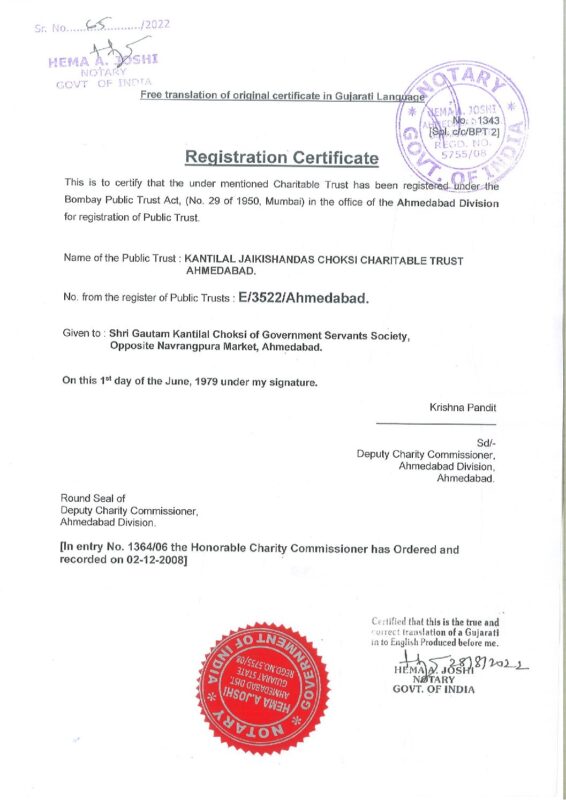

What Is Trust Registration full details

Trust Registration Certificate

What Is Trust Registration?

Trust registration requirements can be complex for those not familiar with the rules. Failure to register a trust could result in a fine of up to PS5,000.

HMRC aims for transparency and openness with regard to beneficial ownership of trusts. It has a responsibility to report to relevant persons any material discrepancy in the register.

What is a Trust?

Trusts are a type of legal entity. They are used to hold assets and property, and can be owned by individuals or companies. The trustees manage the assets for the benefit of others, called beneficiaries. The terms of a trust are set out in a document known as the trust deed.

A person who establishes a trust is called a “settlor” or “grantor.” The trustees are responsible for managing the trust and keeping records. The trustees must declare on the trust register by 31 January each year if the trust receives income, capital gains, or is liable for inheritance tax.

In addition to ensuring compliance with laws and regulations, trusts are often used for charitable purposes. They can also be a way to advance non-commercial activities such as arts, science, education, and the environment. In addition, they can provide donors with tax deductions.

Why Do I Need to Register a Trust?

The main reason that trustees need to register a trust is that they need to meet anti-money laundering regulations. In addition to this, the trust registration service allows HMRC to provide trustees with a unique taxpayer reference for the trust. This is required in order to submit an SA900 Trust and Estate tax return.

Similarly, many financial institutions require ‘obliged entities’ to have registered trusts in order to comply with their anti-money laundering duties. As such, registering a trust is generally necessary to establish business relationships with these institutions.

Another advantage of registering a trust is that it establishes venue over any disputes relating to the trust. This means that any dispute would be heard by the probate court in the county in which the trust is registered. This can be helpful if a disgruntled beneficiary or creditor brings an action against the trustees of the trust. Having the dispute heard in the correct court can potentially reduce legal fees and time spent on resolving disputes.

Who Needs to Register a Trust?

Trust registration is important to ensure that the operations of a trust are carried out within the established legal parameters. It also enables trusts to avail of income tax benefits, and contribute to social sectors such as education, healthcare and social welfare.

The trustees of a trust need to register the trust when it becomes liable for taxes such as income tax, capital gains tax and SDLT (Statutory Residence Tax). The trustees also need to declare on TRS that the trust has come to an end.

There are some exceptions to this requirement – for example, trusts that are not taxable or non-taxable, and trusts that are not UK resident and do not have a UK connection. If a trust is not registered, HMRC will write to the trustees and issue them with a penalty. Trustees must ensure that they provide accurate information on the TRS to avoid penalties. They must also update their details on the TRS as and when they change.

How to Register a Trust

A lead trustee must register the trust within 90 days of it becoming liable to tax or by 1 September 2022 (whichever comes first). The registration will provide the trust with a unique reference number. The public can view some information about registered trusts and their trustees.

Trustees should provide their details, including the name of the trust, the date of the trust document, and the original grantor’s name. They must also give the name of the lead trustee, other trustees, and any protectors. In addition, if the trust is taxable, they must provide their national insurance numbers and passport details.

Trustees should store the registration document in a safe place where it can be easily found, such as with other important documents. In the event of a dispute, having this document can help establish that the trust is valid. It can also be used to show that the trustees are complying with their anti-money laundering obligations.